I recently read Debt: the First 5000 Years by David Graeber, and it has stuck on my mind for a while. It’s one of those “Everybody is wrong about X, here is what you’ve missed in plain sight” -type books; as Chamath would put it, “often wrong, but never in doubt.” It’s worth summarizing here, both because I think you’ll find it interesting, and also because I’m enjoying the challenge of synthesizing all of these ideas together into a compact format.

A lot of people strongly disagree with his work (see the end), and I’ll admit that I got a lot more critical as soon as we entered territory where I know something about the subject material. But that doesn’t mean I didn’t appreciate the book: I really liked it, and it made me think a lot. It reminded me a bit of reading Freud or Girard: it’s impossibly grand in scope, and some of the explanations are pretty ridiculous, but the observations are gripping and uncomfortable. So here’s a summary of what I took away from it.

The origins of money

The book opens with a strong statement: our conventional origin story for money is totally wrong.

Here’s the version of the story we’re usually taught: Before money, commerce happened through bartering. If I had extra wood and you had extra grain, we could negotiate and swap for mutual benefit and both be better off. In popular narrative, bartering and trading fundamentally makes us human. Adam Smith famously wrote in The Wealth of Nations: “Man is an animal that makes bargains: no other animal does this - no dog exchanges bones with another.”

Bartering only works so long as there’s a “coincidence of wants”: we both want what the other has, at the same time. So we invented money as a way to solve the coincidence of wants problem. Instead of having to rely on coincidence or stockpile something that everyone in the village might want for means of exchange, we could instead use tokens or coins. Here’s a pretty typical passage from an economics textbook:

Where the range of traded goods is small, as it is in relatively unsophisticated economies, it is not difficult to find someone to trade with, and barter is often used. In a complex society with many goods, barter exchanges involve an intolerable amount of effort. Imagine trying to find people who offer for sale all the things you buy in a typical trip to the grocer’s, and who are willing to accept goods that you have to offer in exchange for their goods.

Some agreed-upon mediumof exchange (or means of payment) neatly eliminates the double coincidence of wants problem.

In this view, money is an abstract representation of scarcity that we invented in order to suit our commercial needs. In The Wealth of Nations and other influential books, we enshrine these examples of local economies “evolving” currency based on whatever they had at hand: Newfoundland fishermen using cod as currency, European villagers using metal nails as currency, and so forth. But the main form that mattered were coins, whose scarcity was objectively fashioned out of precious metal. Coinage, consequently, ushered in the evolution of banking, and then banking’s killer app: credit.

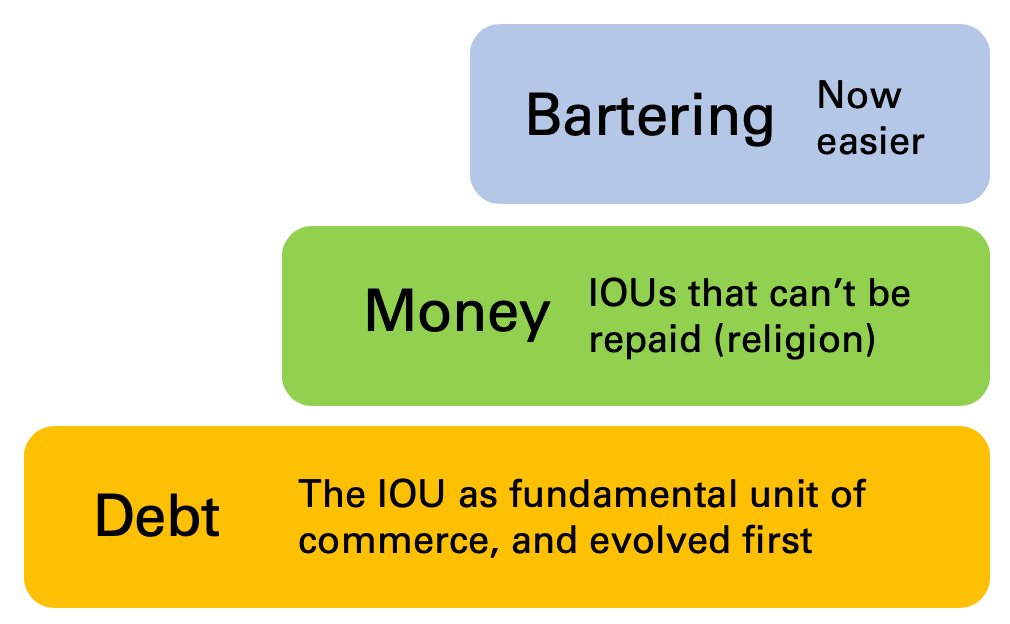

To summarize this view, the foundation of the human economy is built on bartering and swapping for mutual benefit: it makes us human, and let us specialize. Money and coinage evolved as an abstract representation of scarcity, in order to facilitate that bargaining. And then credit and banking evolved on top of that.

According to Graeber, that narrative is fully false, and has the story backwards.

If you went back in time to a prehistoric village and asked, “how do you solve the coincidence of wants problem?” they’d look at you strangely: “What? We don’t have that problem. If I need grain and my neighbour has it, he gives it to me, and then I owe him one.” This idea, “I owe him one”, is simple and powerful: the fundamental unit of commerce isn’t a unit of scarcity, it’s a unit of obligation: the IOU. Credit didn’t come last, it came first.

Although I have not independently done my homework to verify this, if you ask Graeber, he’ll tell you that most anthropologists support this view: there is little evidence that “barter economies” ever actually existed in early civilization. In contrast, there’s a lot of evidence that these early societies had sophisticated local economies long before coinage: not because they were good negotiators, but because they got by perfectly well by using the IOU as a fundamental unit of account. IOUs may have become denominated in some reference terms, but no literal medium of exchange is actually necessary in a system like this.

Accordingly, the “myth of barter” is a false inference: we look back from today (where everything in our life is denominated in dollars) and think, “okay, they must’ve had some early substitute.” Anecdotal examples of prisoners using cigarettes as improvised currency are beloved by economists, but don’t actually tell us anything about the past: those prisoners grew up with modern money, so it’s natural that they might go recreate it.

But in communities where most people know each other, if you never had hard currency in the first place, you might get by perfectly well without it. You’d go through everyday community life with the IOU system, and then resort to barter or other commercial rituals on the occasion where you’d trade with strangers. This system worked well, and it reinforced localism: so long as trust was the dominant unit of commercial account, efficient economies could scale up to around the size of a city, then faced diminishing returns thereafter.

So then where did money come from?

The economist’s perspective goes: “okay, we can see that money made commerce work better, therefore we must’ve invented money in order to improve commerce.” But many anthropologists and historians argue that’s not what happened. The IOU system works perfectly well for debts that can be repaid. Money evolved to solve a different problem, which is how to deal with debts that could not ever be repaid. We’re not talking about commerce here. We’re talking about religion, and debt to God.

This argument also makes a lot of sense once you think about it: the original driving force behind money and precious metals wasn’t trade, it was tribute. Tribute isn’t ever repaid, so the IOU system doesn’t work. So we needed something else, and that’s where precious metals and coins emerge on the scene.

Graeber argues that we have the wrong idea about the basic life cycle of currency in early history, and for that matter, until a few centuries ago. The average life cycle of early coins was not facilitating trade among stranger after stranger. A typical coin or precious metal object might be exchanged once or twice, but then promptly deposited at the local temple or church as tribute, where it would then remain permanently.

That second model feels more consistent with historical and anthropological record than the first one. Ordinary people simply did not use coins that much, even in early civilizations that did evolve coinage, because the IOU system worked so well. Again, they very well may have quantified their IOUs in terms of currency, simply for convenience, but that doesn’t mean they actually used currency for trading.

When they did use coins, it was primarily around two kinds of debts. First, “eternal debts”: occasions like religious tribute, dowries at weddings, and other monumental occasions where large social or moral debts were taken on or transferred. Second, “injurious debts”: settling wrongs in situations where trust has broken down, and one party is seen as “in the wrong”, and compelled to pay what is effectively tribute to the injured party. Neither of these have anything to do with commerce.

So what happened? How did hard currency take over commerce? During the Axial Age (the last few centuries BC) we saw the rise of Roman, Indian and Chinese empires that all evolved hard currency systems that infiltrated all of commerce. Economic historians usually describe this evolution as logical steps into advanced civilization. But Graeber will tell you otherwise: hard metal coinage comes from violence, war, and as he calls it, the “Military-coinage-slave complex” of empire.

Early “soft” credit systems may have supported remarkably large and sophisticated economies, but there was one thing they couldn’t pay for very well: war. First of all, you can’t pay armies in IOUs, because they’re too mobile: when you march to faraway places, credit effectiveness diminishes with distance. But the main reason is more cruel: metal coinage is a really effective way to economically enslave a conquered nation.

The way it works is: your army marches on another nation, conquers it and seizes their riches. Then you demand further payment from the people you’ve just conquered; either in the form of outright debt (for “damages incurred”), new taxes, or both. Since you’re in power, you can demand those tax and tribute payments be fulfilled in your own hard metal currency, with interest. The conquered people now have to somehow obtain those physical coins in order to pay their taxes, which puts them at an enormous disadvantage in trading: they must accept any terms they can get for their own labour. What looks like a “global free market”, facilitated by universal coins, is really just debt peonage. The coins don’t facilitate; they restrict.

Graeber’s broader point is that all debt, especially interest-drawing debt, is intimately related to its enforcement mechanism. IOUs don’t exist in a vacuum; they’re made in societal context. In an economic system where money is fundamentally a unit of trust, the rules around recoupment and enforcement of debts are made in an environment where people generally know each other, so we see recurring features like strong creditor protection and pretty sophisticated dispute resolution. In contrast, when money is a hard, fungible unit of scarcity, enforcement isn’t a matter of trust; it’s a matter of force. When your enforcement mechanism is state-backed violence, lenders and debtors have a pretty different relationship.

The Two Sides of Money

At this point, we’re ready to understand the two main theses of the book. The first thesis is concerns the duality of money, as both a unit of trust and a unit of scarcity. Money will always be some of both. Each “side” of money is a positive feedback cycle. The “unit of trust” side is a reinforcing cycle of merchant power, trust, and localism. The “unit of scarcity” side is a reinforcing cycle of military power, debt peonage, and empire. (You can probably guess which side he prefers.)

It’s helpful to articulate this thesis as essentially “Anti-Adam Smith.” The Wealth of Nations describes a world of commerce that’s founded on the idea that people are free to choose how they want to work, with currency as a universal intermediary. Graeber would counter that genuinely free trade, when it historically occurs, is usually transacted in IOUs, not hard currency. When hard currency shows up, it’s usually in a military or colonial context. He would probably summarize it: “If it’s a free market, they aren’t using silver. If they are, it isn’t a free market.”

The second thesis of the book is that these two positive feedback cycles are not in equilibrium with each other. World history has progressed in cycles where one has dominated, then the other. Early civilizations had thriving commercial economies on the IOU system, while gold and silver became valued as religious tribute. Then during the Axial age, metal became commercial money. The rise of coinage coincided with a rise in organized military power and empire building in Rome, India and China, as I mentioned before.

The Middle Ages saw a swing back to the old ways of doing things, where precious metals were largely confined to tribute while free trade flourished under the IOU system. Of course, the “Middle Ages” did not mean the dark, forgotten years where Western Europe didn’t do much; the rest of the world flourished between 600 and 1500, particularly the Middle East, Central, and East Asia.

Here we spend a lot of time talking about free trade under Islamic rule, and how commerce worked in an environment where lending money at interest was forbidden. I’ve repeatedly heard the assertion that usury laws historically held back banking and commercial evolution, but Graeber (as usual) paints a different picture here. By all accounts, the Islamic world at this time did indeed see free trade flourish for hundreds of years, with little violence. To Graeber, this again shows the triumph of the IOU system. With ordinary people free from the weight of interest payments or the restriction of coinage, they were actually free to pursue Adam Smith’s free market ideal, while the foundation of debt was mutual trust and not state-sponsored enforcement.

As before, precious metals were still around - just not really in commerce. For the most part, gold and silver got stockpiled in monasteries and temples, or was minted by kings primarily in order to fund armies for local conflicts. “Recoinage” was a relatively frequent occurrence, where kings had to recall and reissue currency to fund their conflicts because there simply wasn’t enough metal circulating - too much was stuck inside the temples. I’d mostly heard before that recoinings were economically disruptive events. But maybe they weren’t. Ordinary people didn’t hold any coins, and didn’t transact with coins, so they probably didn’t care.

Then the world turned back towards empire again. One bit of world history I’d never heard before reading this book, which Graeber nominates as “the most consequential twist of history that no one remembers”, is how China turned away from the IOU system and went back to precious metal currency in the 1400s. (Remember, by the way, that for most of world history the Chinese economy was the biggest and richest in the world, and was always connected to everyone else.)

China switching back to gold and silver set off a chain of events that changed everything. Everyone else suddenly had to go find precious metal, and lo and behold, Europeans had just "discovered" a whole lot of it in Central America. You probably know what happened next, which is 500 years of unthinkable brutality, conquest and empire-building. The precious metal positive feedback cycle went into high gear, and dragged the world along with it. The mercantile, free trade era was over; the globalized colonial slave trade was in.

As we approach current-day history, we get into increasingly documented territory: the world wars, the rise of America and the US dollar, and our move off the gold standard in 1971. Graeber tentatively calls our current period “The beginning of something yet to be determined”, and he first published the book in 2011, fresh off the financial crisis. I’ll leave you to read the book if you want his take on our current world, which I mostly don’t agree with, but it’s interesting and consistent with the rest of the book.

It’s also hard not to read this book in the context of what’s going on with Bitcoin right now, which is basically a pure, digital expression of money as fungible, abstract scarcity, where interpersonal trust has been fully engineered out of the picture. (If you’ve read my other stuff on cryptocurrency you may have a sense of my stance on this.)

Not everybody likes this book, and it has some vocal critics like Jeff Hummel and Brad DeLong. (Thanks to Barry Cotter for these links.) Tyler Cowen has a good one-line summary: "The book overinterprets early historical evidence and falls apart as it approaches contemporary times, still it has a vitality which many other tracts lack.” I think that’s a pretty fair summary. The really early stuff, no one knows; it’s all guessing. The current-day part, in my opinion, is written way to ideologically and really distorts the way that modern corporations work, in particular. Still, he’s arguing it honestly, and I appreciated the book a lot.

In this week’s reading, here’s a good piece from Gavin Baker on why it pays to be Number One on the internet, how Number One brands are continual thorns in the side of Google and Facebook, and why it’s so important to establish omnichannel customer acquisition:

Here is a neat tidbit from Gary Basin on how abundant choice often seems like a better idea than it actually is. It resonated a lot with me, since one of the recurring themes in my writing is variety of choice as both a driving factor for the abundance flywheel, but also as a driver of emergent scarcity.

Choice is like junk food | Gary Basin

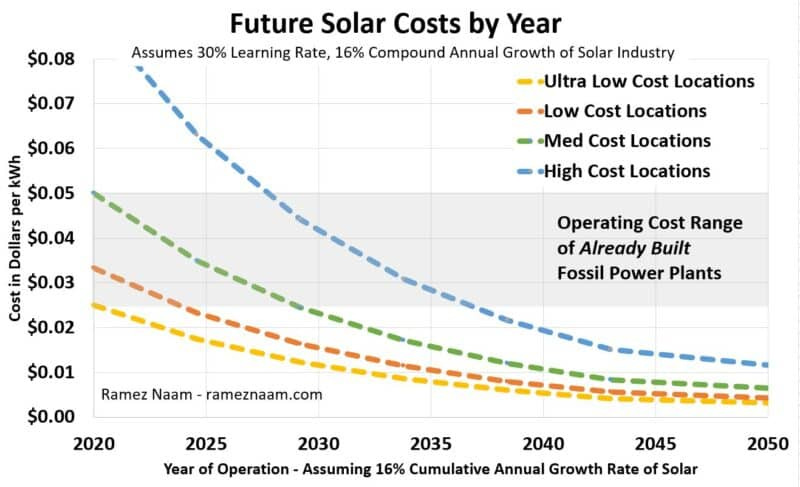

Good news from the energy front, from Ramez Naam. I remember when he wrote this original series on renewable energy projections in 2015, back when he put up optimistic projections that overshot anything the “serious people” were forecasting. Five years later, he’s back to let us know that even his wildly optimistic forecast understate what’s happening to the world’s energy mix (although even so, solar alone won’t fix climate).

Solar’s future is insanely cheap (2020) | Ramez Naam

And finally, in this week’s comics section, here’s a little genius for you:

Have a great week,

Alex